The construction sector in the Philippines has been a driving force behind the country’s economic growth for many years. However, the current price fluctuations of the Philippine peso have introduced a new layer of uncertainty for the industry.

According to the National Statistics Office, the construction industry contributed 7% to the country’s GDP in 2023. This highlights its significance as a key economic driver.

Just last April, financial analysts predicted the weakening of the Philippine peso, expecting it to stay within the ₱57 to ₱58 range, which is roughly around $1 today. However, as we enter well into the third quarter of 2024, GDP has expanded by 6.3%, fueled by international interest in investing in the local equities market. This puts the Philippine peso back on track to become an upper-middle-income country (UMIC) by 2025—a significant goal that will benefit most of the country’s industries, including the construction industry.

Significant opportunities are now within reach for the Philippine construction industry. In addition to the rising GDP, the government’s infrastructure development plans, such as the Build Better More program (a continuation of the previous Duterte administration’s Build, Build, Build program), are currently driving the demand for construction services.

Understanding the impact of economic fluctuations on the construction industry is essential for just about everybody. Stakeholders can make informed decisions and adapt their strategies to navigate the current landscape, while business owners in the construction industry can better prepare themselves for forecasted changes. For the average homeowner, knowing how the current value of the peso affects the construction industry provides a clearer picture of the potential costs of their dream property.

In this article, let’s understand how such economic shifts can affect the construction industry.

Economic Contribution of the Construction Sector

The construction sector is vital to the Philippine economy. During the second quarter of 2024, the industry was one of the biggest contributors to growth, accounting for 16% of the country’s GDP expansion.

This sector is not only a major driver of economic growth but also a significant source of employment, providing jobs to thousands of Filipinos. Through its extensive supply chain, the industry attracts significant foreign investment and stimulates various other sectors, further enhancing its role in the economic landscape.

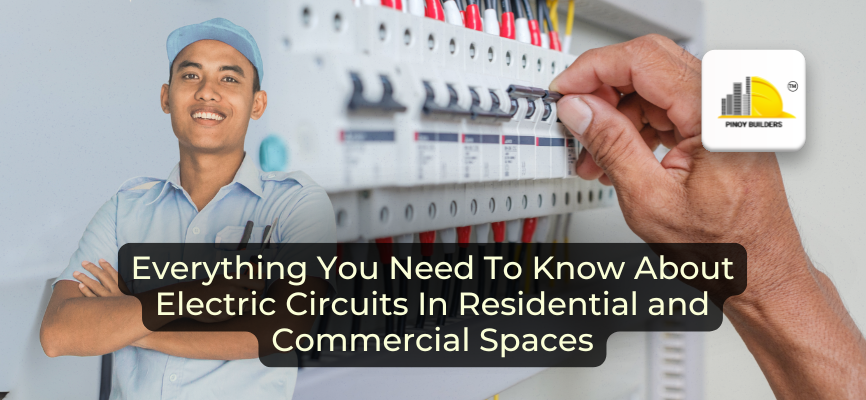

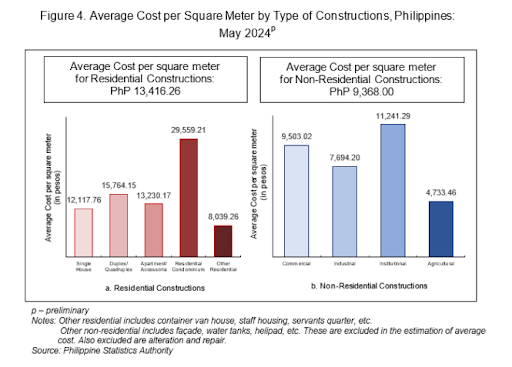

Image from Philippine Statistics Authority

The government’s infrastructure programs, such as the “Build Better More” initiative, continue the ambitious goals of the previous “Build! Build! Build!” program. These projects include major undertakings like the Metro Manila Subway and various railway extensions. However, the completion of only a fraction of these projects as of April 2024 underscores the reliance on government funding, official development assistance, and public-private partnerships for ongoing progress.

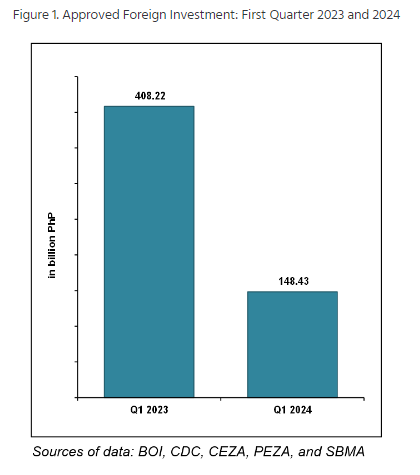

Number of Philippine government infrastructure flagship projects (IFPs) as of April 2024, by sector

The Peso’s Impact on Construction Costs

Labor Costs

In the construction sector, fluctuations in the peso have a significant influence on labor costs. As inflation rates hover around 6% and interest rates remain high, managing staffing and project expenses becomes increasingly challenging.

Rising living costs affect wages, while high interest rates impact borrowing costs for project financing, putting additional strain on budgets.

Material Costs

The cost of materials is one of the most affected aspects of the Philippine peso’s fluctuating value. The value of the peso directly affects the cost of imported construction materials. As the peso depreciates, the cost of materials such as steel, cement, and machinery rises, putting financial pressure on developers and contractors.

In May 2024, the average construction cost was recorded at ₱11,296.89 per square meter, reflecting a 2.8% increase from ₱10,990.94 per square meter in May 2023. Notably, this data excludes alteration and repair work, as well as other non-residential constructions like facades, helipads, niches, and water tanks that do not have reported floor areas.

Among different types of construction, residential buildings had the highest average cost of ₱13,416.26 per square meter. This was followed by non-residential construction at ₱9,368.00 per square meter and additions to existing construction at ₱9,333.43 per square meter.

For residential projects, condominium-type constructions had the highest average cost at ₱29,559.21 per square meter, whereas other residential types, such as container van houses and staff housing, recorded the lowest average cost at ₱8,039.26 per square meter.

In the non-residential category, institutional buildings had the highest average cost of ₱11,241.29 per square meter, while agricultural-type buildings registered the lowest cost at ₱4,733.46 per square meter. These figures illustrate the significant impact of peso fluctuations on construction costs, highlighting the need for effective cost management and planning.

Budget and Timeline

The fluctuating costs due to peso volatility have an impact on overall project budgets and timelines. Projects often face delays and cost overruns as material and labor costs shift unpredictably. For instance, unexpectedly high material costs and financing challenges have caused delays in some ongoing projects, underscoring the importance of meticulous budgeting and adaptable project management.

Challenges Faced by the Construction Industry

- Inflation and High Interest Rates The construction industry grapples with the effects of inflation and rising interest rates. Increased material costs and higher borrowing costs hinder project financing and profitability. The industry’s recovery is further complicated by these economic pressures, which impact investment and operational costs.

- Supply Chain Disruptions The COVID-19 pandemic has had lasting effects on supply chains, causing delays and increased costs. Although restrictions have eased in 2022, disruptions in the supply chain continue to affect the timely delivery of materials and equipment, contributing to project delays and budget overruns.

- Labor Shortages A significant shortage of skilled labor further complicates project completion. Factors such as limited training opportunities, an aging workforce, and migration of skilled workers abroad contribute to the skills gap. This shortage affects productivity and increases project costs.

Adopting To Peso Devaluation: Strategies For Coping With A Weakening Peso

Understanding strategies for coping with peso devaluation is essential because it directly impacts purchasing power, business profitability, and overall economic stability. By adopting effective measures, individuals and businesses can mitigate financial risks and ensure resilience in a fluctuating economic environment.

- Cost Management

Effective cost management strategies are essential in navigating an inconsistent currency environment. This includes implementing budget controls, exploring cost-effective materials, and adopting efficient project management practices to mitigate the impact of fluctuating costs.

- Diversifying Supply Chains

Diversifying suppliers and sourcing materials locally can help to reduce dependency on imported goods and mitigate the impact of peso devaluation. Building relationships with multiple suppliers can help manage costs and ensure a steady supply of materials.

- Investing in Technology

Adopting construction technologies such as Building Information Modeling (BIM) and project management software can improve efficiency and reduce costs. Technology investments can streamline operations and enhance project outcomes, offsetting some of the financial pressures from fluctuating costs.

The Current Peso and The Construction Industry

The current value of the peso presents both challenges and opportunities for the Philippine construction industry. By understanding and adapting to these economic fluctuations, industry stakeholders can better manage costs and make sure to capitalize on emerging opportunities. Strategic approaches are essential for navigating these economic shifts and ensuring sustained growth in the construction sector.

References

Balita, C. (2024, July 11). Philippines: government infrastructure projects by sector 2024. Statista. Retrieved August 27, 2024, from https://www.statista.com/statistics/1479568/philippines-number-infrastructure-projects-government-by-sector/

Balita, C. (2024, July 15). Construction sector in the Philippines – statistics & facts. Statista. Retrieved August 27, 2024, from https://www.statista.com/topics/6011/construction-sector-in-the-philippines/

Business World. (n.d.). Construction industry sentiment positive over next 12 months — survey. Business World. https://www.bworldonline.com/economy/2023/06/20/529827/construction-industry-sentiment-positive-over-next-12-months-survey/

Manila Standard. (n.d.). Stable peso paves road to becoming UMIC. Manila Standard. https://www.manilastandard.net/spotlight/towards-umic-status-by-2025-ph-future-proofs-economy/314489051/stable-peso-paves-road-to-becoming-umic.html

Penarroyo, F. (2024, June 26). “Challenges and Outlook for the Construction Industry” — News — Philippine Resources Journal. Philippine Resources Journal. Retrieved August 27, 2024, from https://www.philippine-resources.com/articles/2024/6/challenges-and-outlook-for-the-construction-industry

Philippine Statistics Authority. (2024, May 16). Approved Foreign Investments Reach PhP 148.43 Billion in the First Quarter of 2024. Philippine Statistics Authority. Retrieved August 27, 2024, from https://psa.gov.ph/content/approved-foreign-investments-reach-php-14843-billion-first-quarter-2024

Philippine Statistics Authority. (2024, August 7). Construction Statistics from Approved Building Permits May 2024. Philippine Statistics Authority. Retrieved August 27, 2024, from https://psa.gov.ph/statistics/construction/pcs